If you do not clear all 3 exams within the 2-year period from the date of enrollment, it means you will not be eligible for the full refund of the course fee. You will only be able to claim the 50% refund on completing the course and clearing the internal test, as per the initial condition. The remaining 50% refund, which was contingent upon passing all 3 EA exam parts, will not be applicable in this scenario. Therefore, you will lose the opportunity to receive the full refund of the course fee if you do not clear all 3 exams within the specified 2-year period.

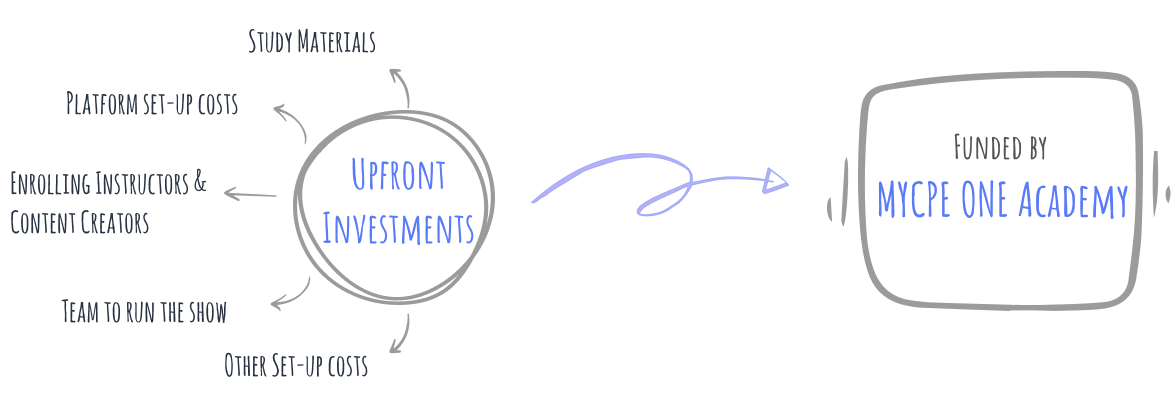

We would be using the retention fee to support our cost of operation incurred in bettering the materials, platform, technology, and overall user experience.